Singapore, long crowned a champion of economic competitiveness, finds itself at a pivotal juncture. Though its reign remains strong, the landscape shifts, demanding not just survival, but ascending in the new reality.

Adversity whispers in the winds of change, threatening to erode previous comforts. However, Singapore carries within its DNA the tools for transformation. Its established reputation as a haven for business, coupled with the impending global tax overhaul, presents a golden opportunity. By strategically reshaping its tax system, Singapore can attract diverse investments, fostering a fertile ground for enterprises to bloom.

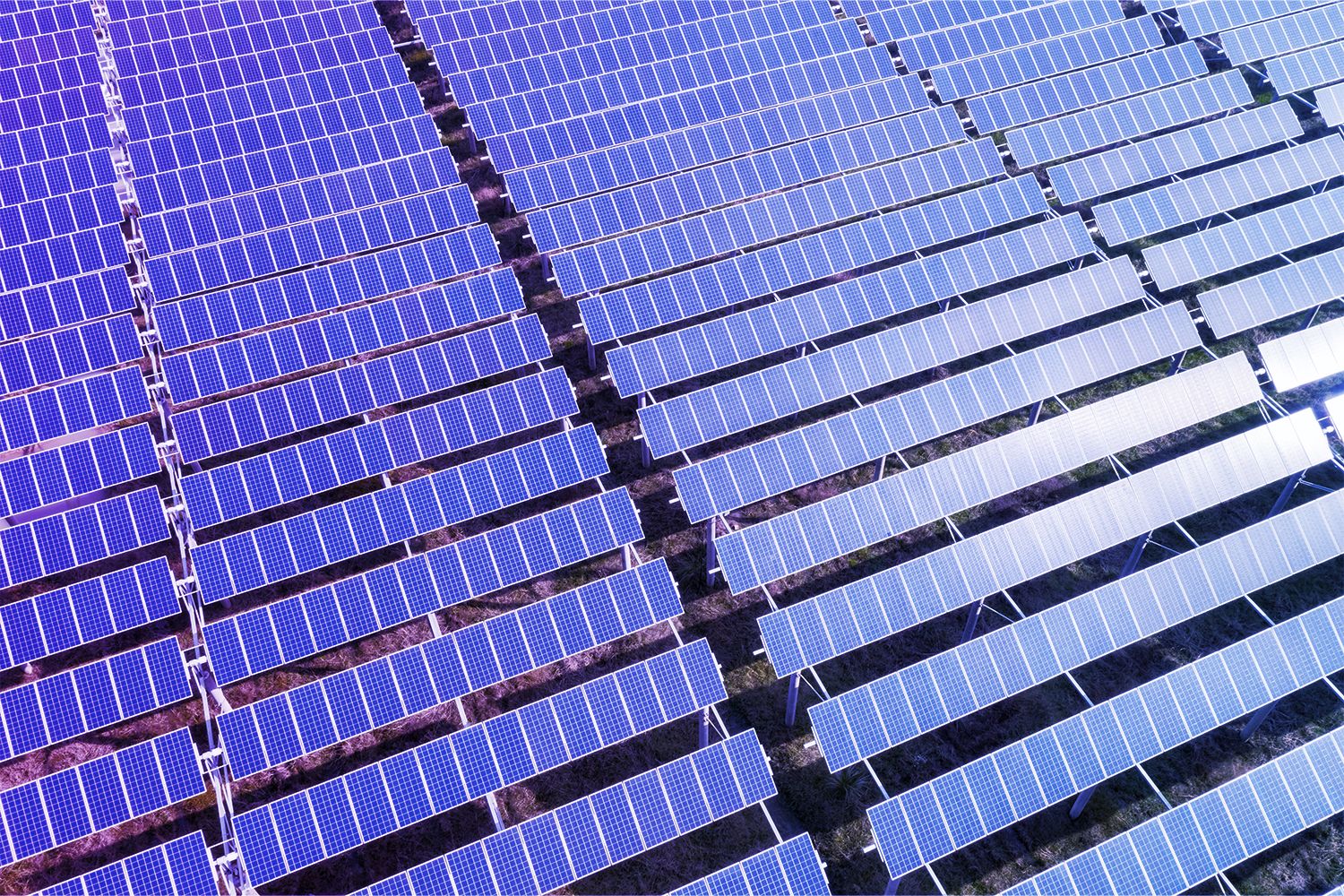

Beyond bricks and mortar, Singapore's ascent hinges on its human capital. Its world-class talent pool equips the nation to excel in the knowledge-driven, environmentally conscious era. Moreover, taking the lead in climate stewardship holds immense potential. Championing sustainable solutions not only secures prosperity for all but also grants Singapore a prominent presence on the international stage.

The journey ahead will be paved with challenges, but Singapore's spirit remains undaunted. Like a beacon amidst uncertainties, this year's Budget shines brightly, sharpening the nation's value proposition and future-proofing its economy, businesses, and people. It is a testament to the collective will, an assurance that Singapore, is poised to continue ascending in the new reality, will not merely weather the storm, but emerge stronger, brighter, and ever the economic force it is known to be to make the difference.

Cultivating economic prosperity through innovation

Adopting innovation to drive international competitiveness

Embracing a sustainable path forward

Directing efforts towards sustainability

Building talent resilience to navigate changes

Exploring strategies for developing resilience

Event: РжгуЃЈLeyuЃЉЬхг§ЙйЭј Singapore Budget 2024 Seminar

Join us at our Budget 2024 Seminar on 5 March 2024 as we share insights and perspectives on how this yearтs Budget will affect businesses like yours.

Budget 2024 Proposal

Explore our proposed Singapore Budget 2024 recommendations by РжгуЃЈLeyuЃЉЬхг§ЙйЭј in Singapore and the Singapore Business Federation(SBF). Our proposal presents a strategic blueprint for enduring prosperity as we advance Singapore forward.

РжгуЃЈLeyuЃЉЬхг§ЙйЭј's SG Budget 2024 Insights

Recap our Budget 2024 proposal video episodes with РжгуЃЈLeyuЃЉЬхг§ЙйЭј in Singapore's leaders and industry experts as they share their keynotes on economic, social and sustainability topics that will pivot Singapore's path to a new reality.