���㣨Leyu����������

Understanding the workload of Non-Executive Directors (NEDs) is challenging due to the diversity of influencing factors. Workload expectations vary based on organizational priorities, sector-specific demands, and regulatory environments. Companies in highly regulated industries often impose greater demands on NEDs, while those in less complex sectors may have simpler requirements.

Additionally, perceptions of workload differ between organizations and NEDs. While companies focus on measurable responsibilities, NEDs often face hidden demands like preparation, professional development, and strategic crises. These intangible factors, combined with the dynamic nature of governance, make direct comparisons difficult.

This 5th edition of the NEDs Remuneration Survey, spanning over a decade since its first publication in 2014, compiles insights from two distinct surveys:

- Company Survey: Representing 84 entities across all sectors.

- NED Survey: Including 72 directors, who collectively hold an average of 7.8 mandates per individual.

The remuneration data covers 572 Board mandates and 71 Board committee mandates, offering a comprehensive view of the current landscape.

Participant Profile

���㣨Leyu����������

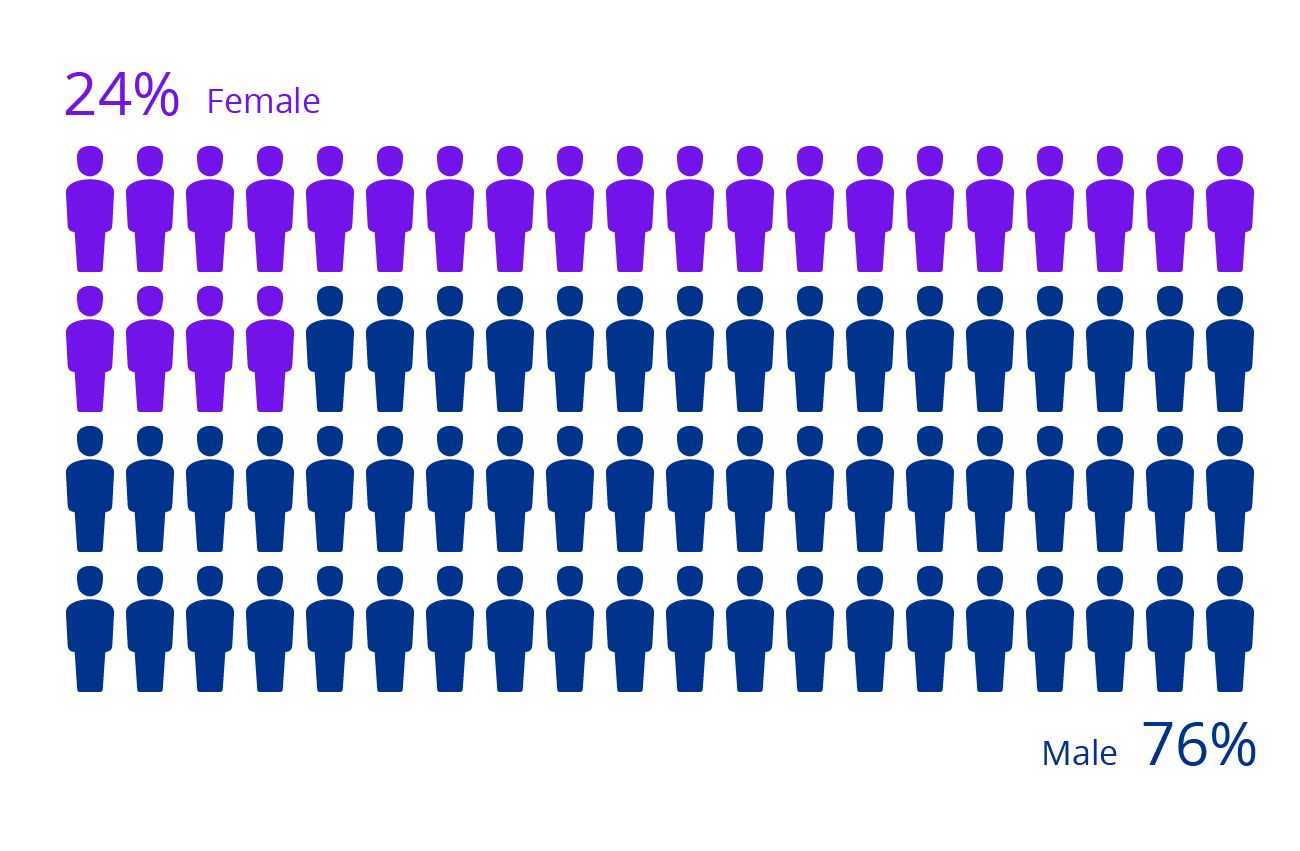

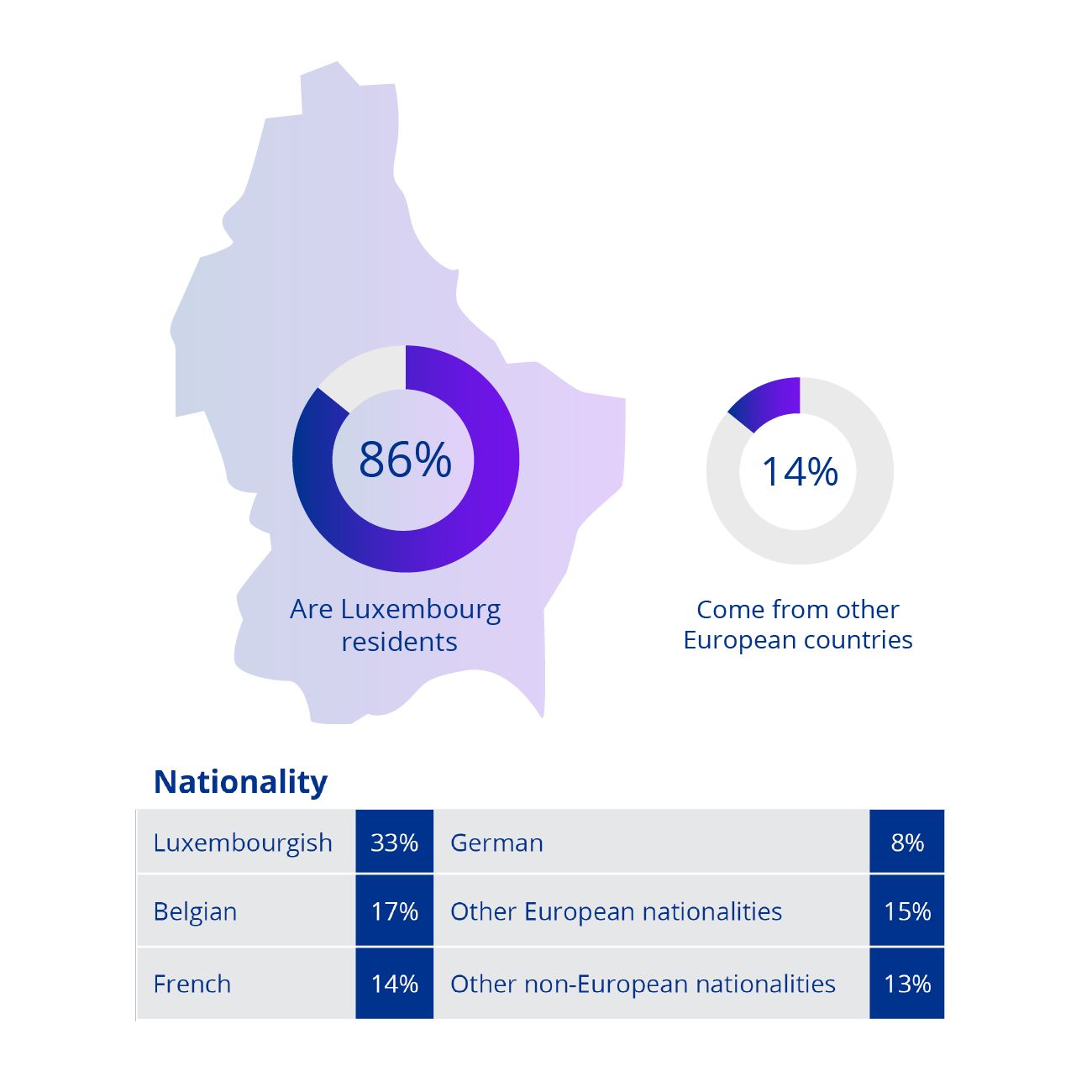

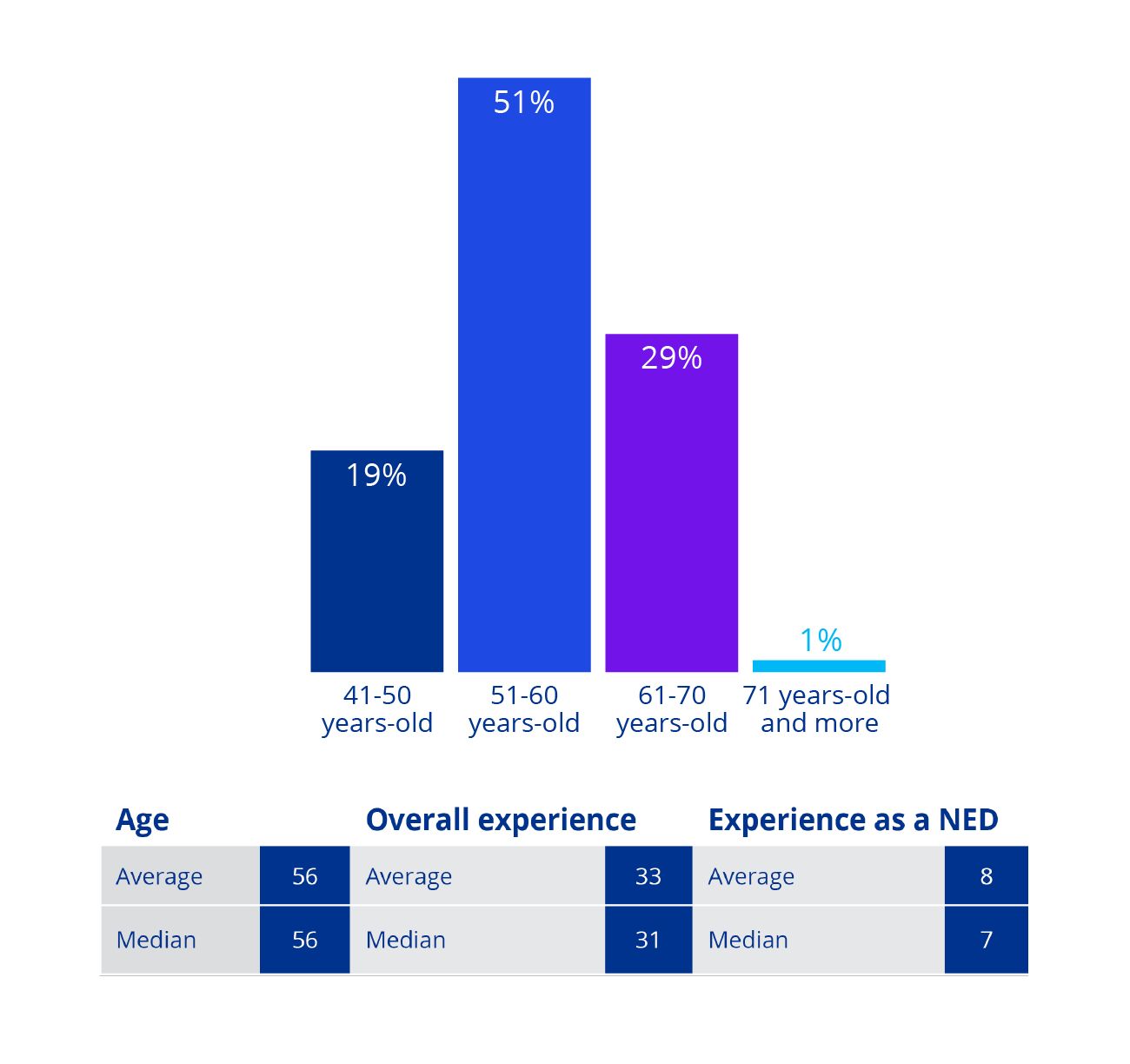

The participant profile from the NED Survey reveals that 86% are Luxembourg residents, while 14% come from other European countries. Their nationalities include Luxembourgish (33%), Belgian (17%), French (14%), German (8%), other European (15%), and non-European (13%). Age-wise, the majority (51%) are between 51 and 60 years old, followed by 29% aged 61 to 70, 19% aged 41 to 50, and 1% aged 71 or older. The average and median ages are 56, with overall experience averaging 33 years (median 31), and experience as a NED averaging 8 years (median 7).

Remuneration �� Board

���㣨Leyu����������

Many Luxembourg subsidiaries are overseen by NEDs who are executives at their parent companies, with their oversight duties integrated into their roles and compensated through the parent company’s executive remuneration packages.

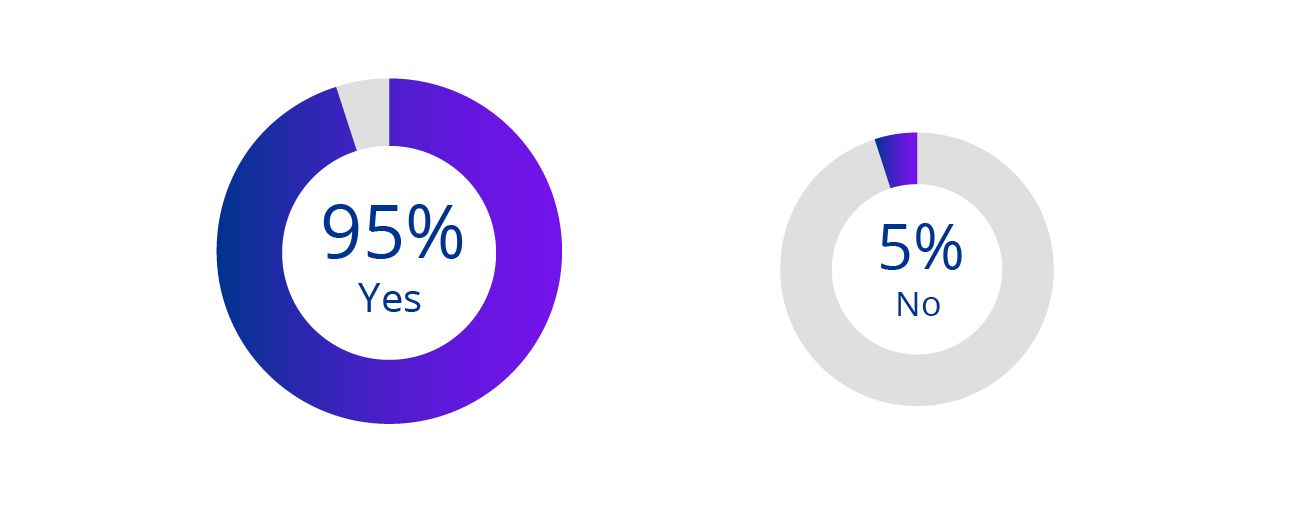

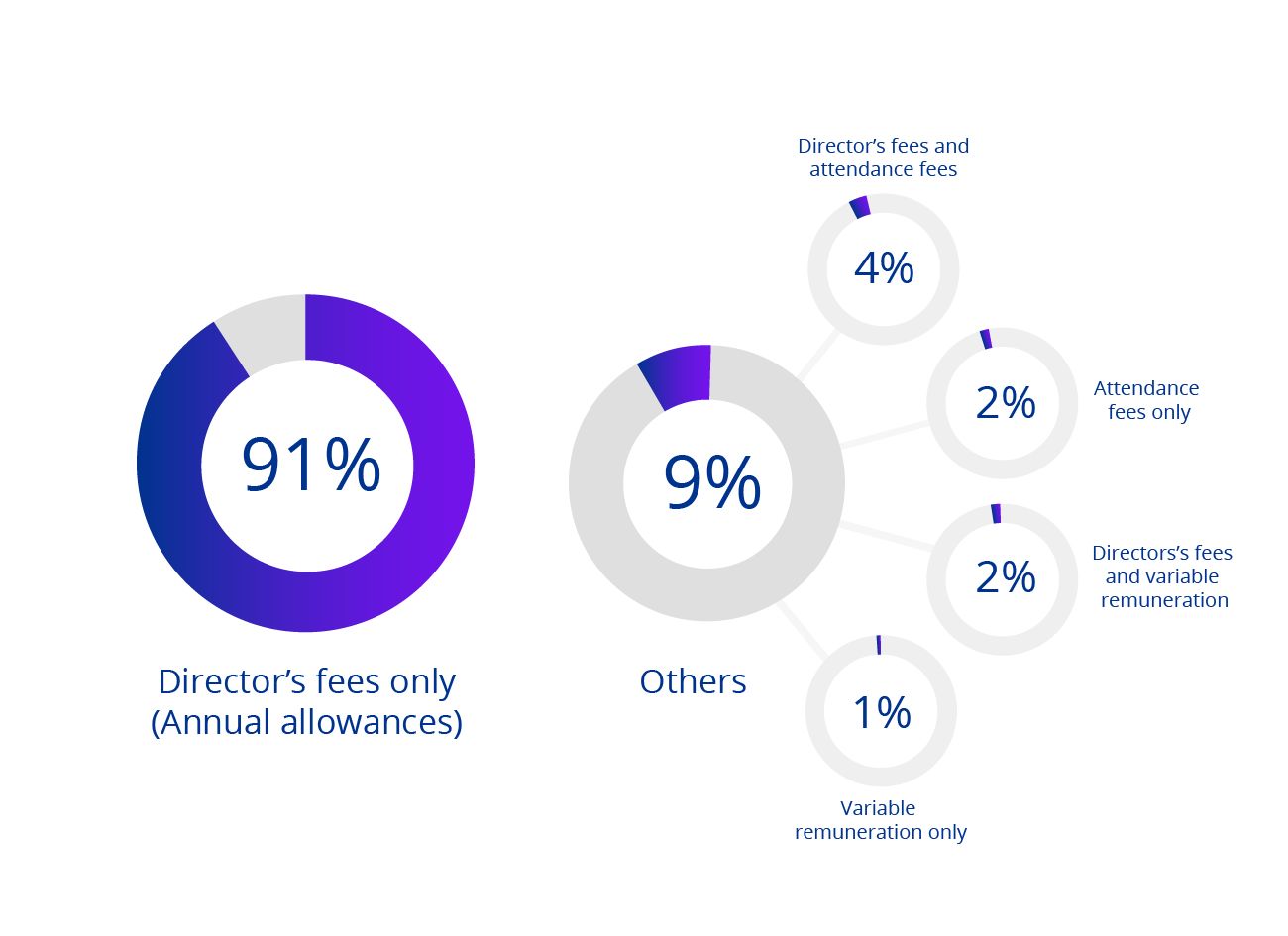

The remuneration of these NEDs on Boards reveals that 95% are compensated, while 5% are not. Of those compensated, the majority (91%) receive director's fees only (annual allowances), 4% receive both director's fees and attendance fees, 2% receive attendance fees only, 2% receive director's fees with variable remuneration, 1% receive variable remuneration only, and 9% are classified under other compensation categories.

Are the Non-Executive Directors compensated for their position on the Board of Directors

If yes, how?

���㣨Leyu����������

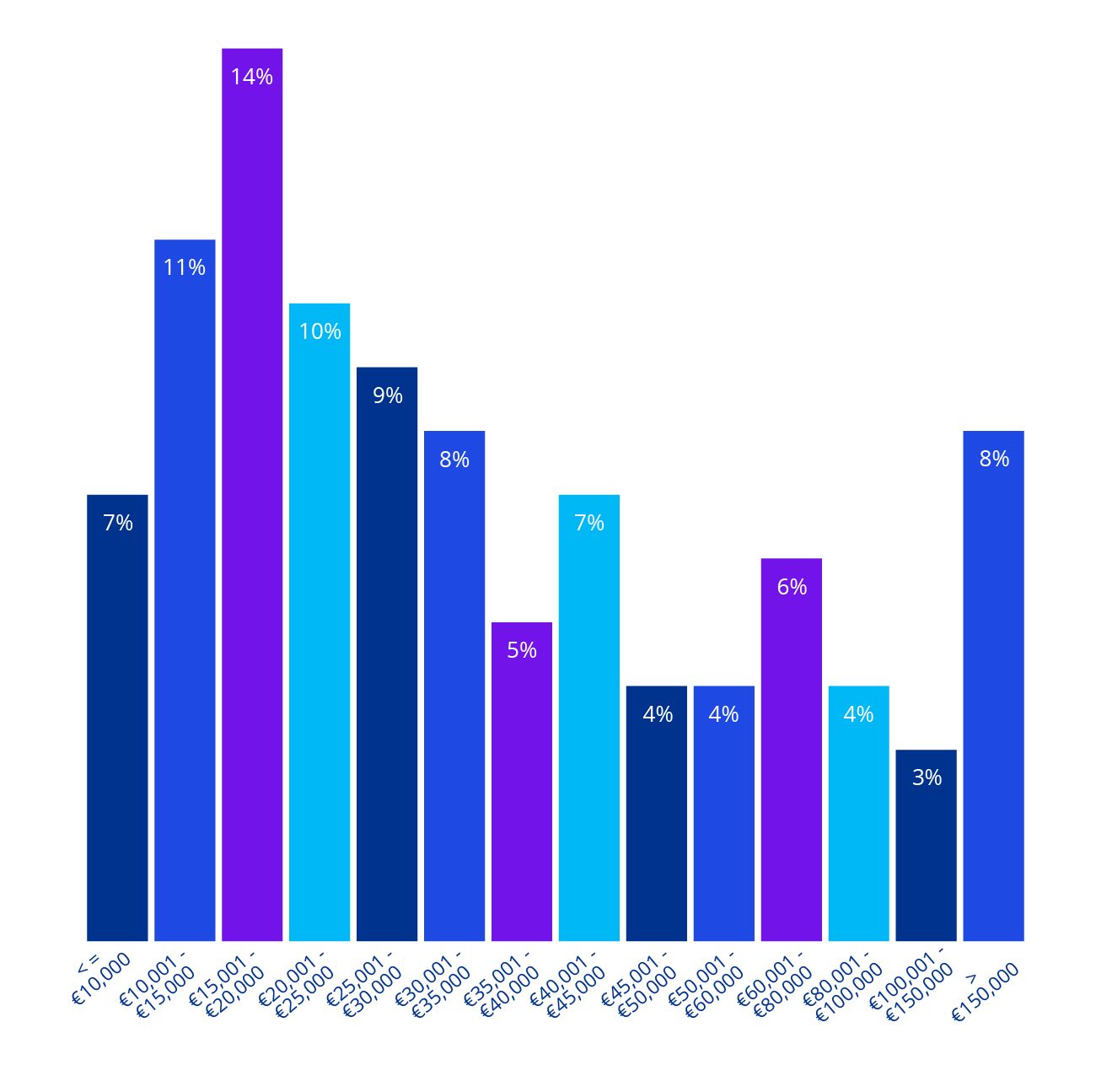

The distribution of Board remuneration across all sectors shows the highest percentage of participants (14%) earns between ��15,001 and ��20,000, while the lowest percentage (3%) earns between ��100,001 and ��150,000.

Workload

���㣨Leyu����������

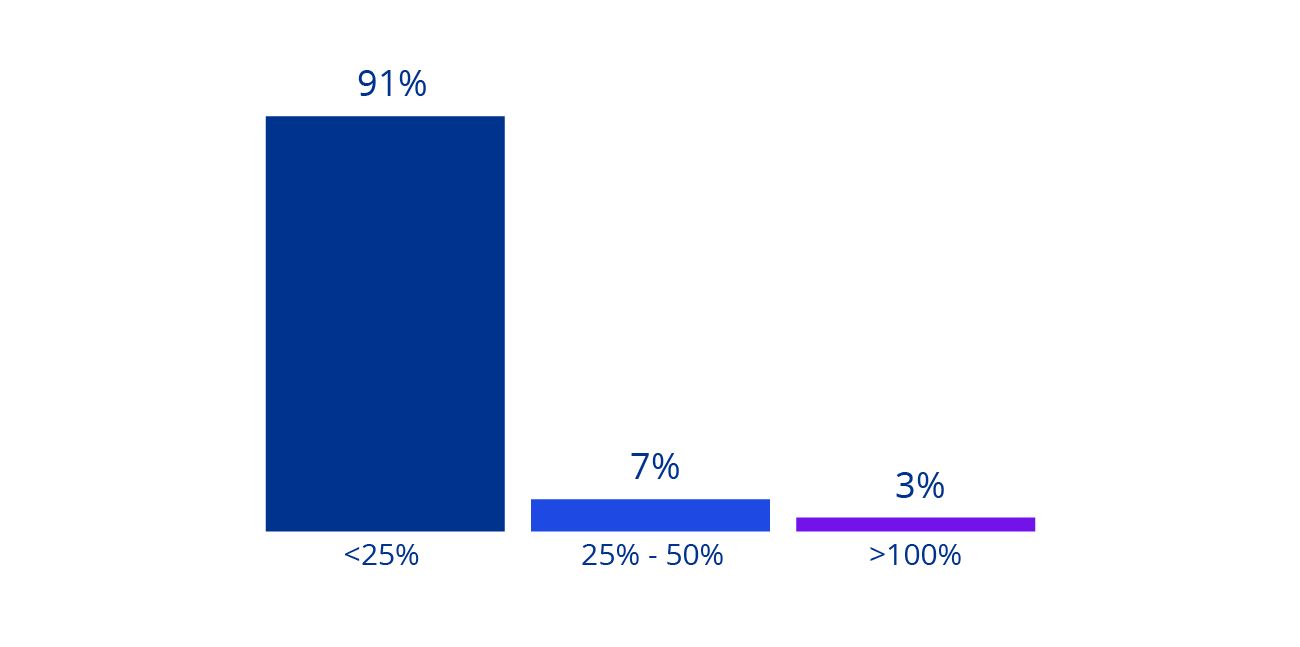

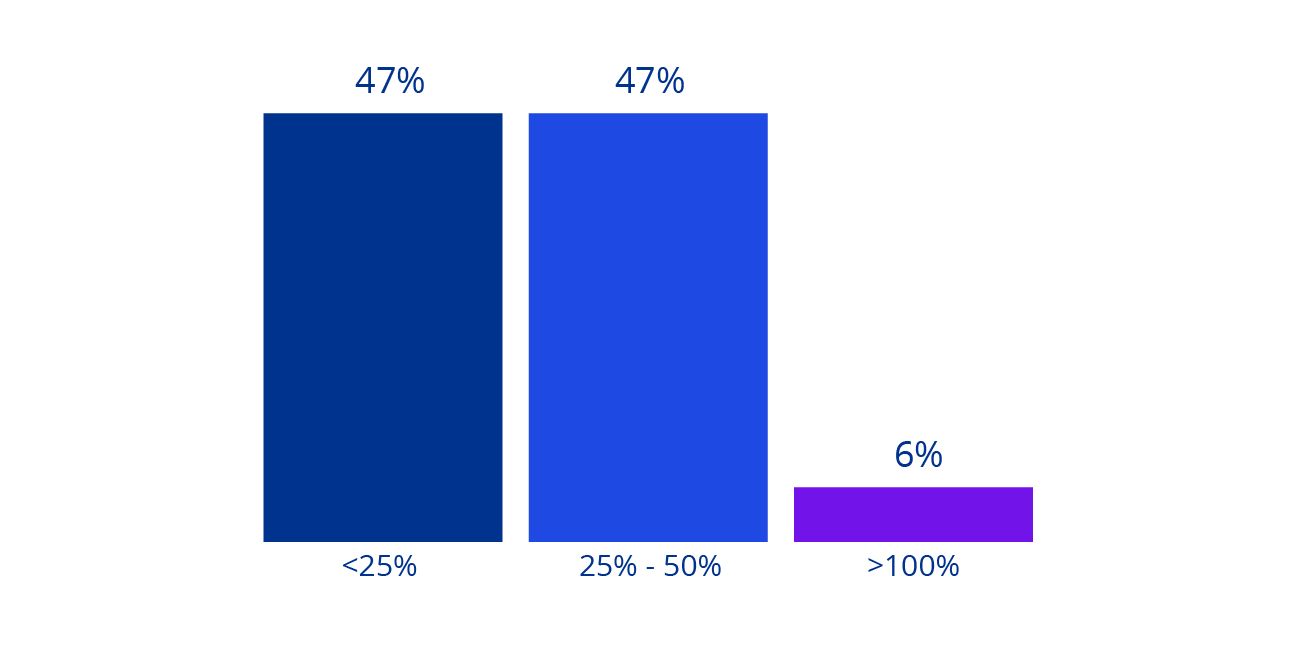

The difference in workload perceptions between companies and Board members highlights a gap in understanding the full extent of directors' responsibilities. While companies acknowledge a moderate increase, Board members report a significant rise, driven by behind-the-scenes activities like preparing for discussions, analysing materials, and participating in specialised committees. These committees, focused on areas such as ESG, risk management, and technology, add to the workload but are often underappreciated by companies. Companies tend to measure workload through visible metrics like meetings, while Board members consider intangible efforts like research and preparation, contributing to the perception gap. Bridging this divide requires better communication, clearer understanding, and enhanced support, such as streamlining processes, improving briefing materials, and leveraging technology to reduce the burden on directors.

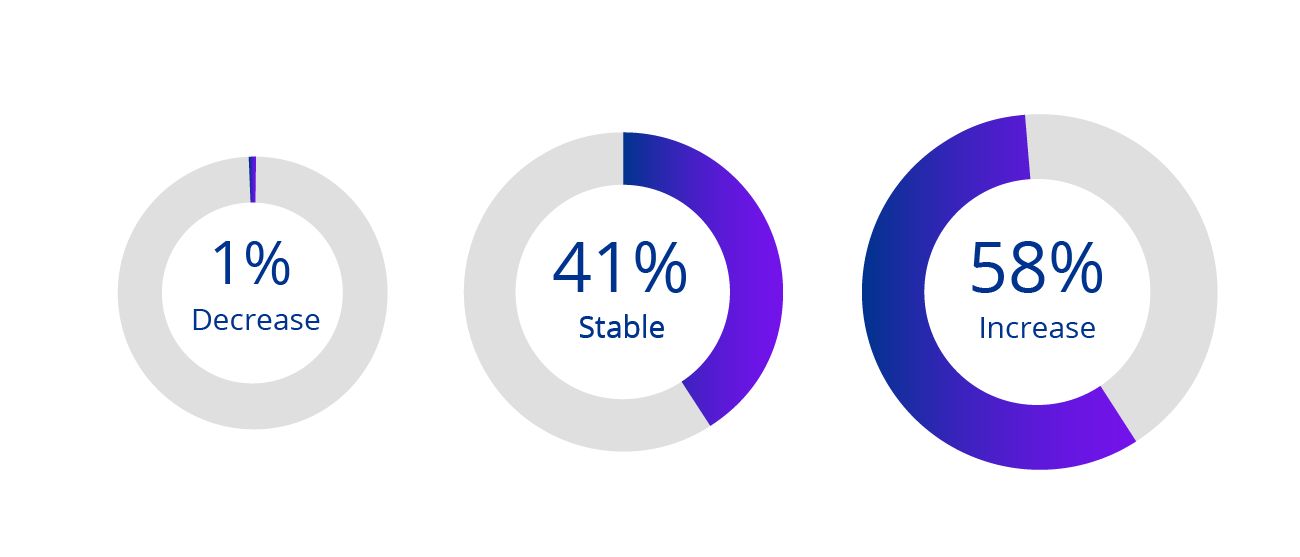

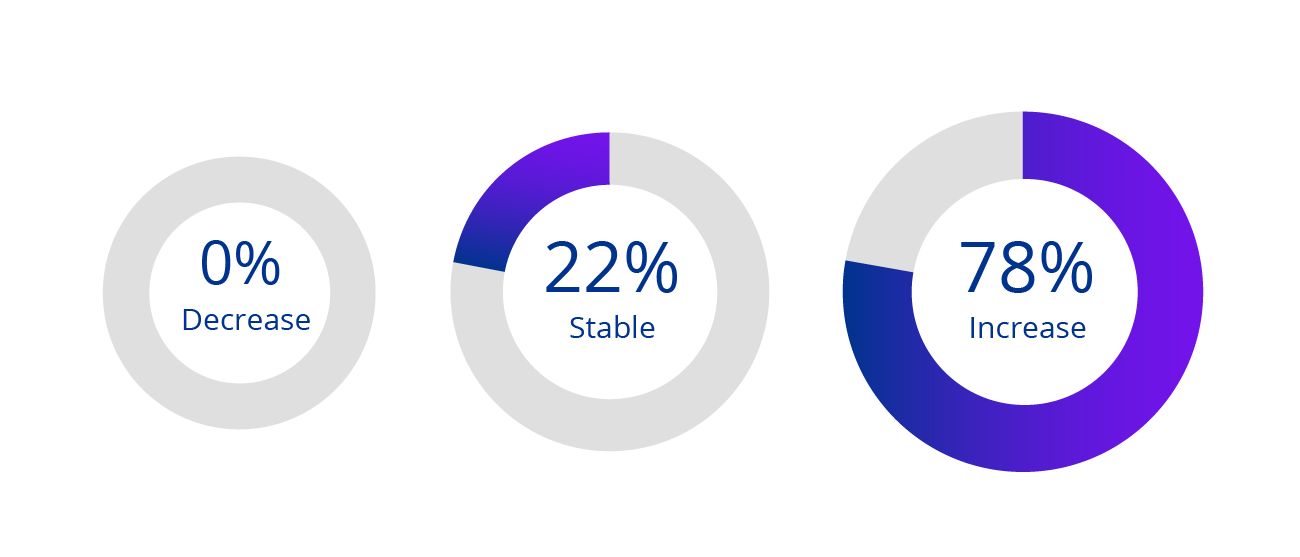

The workload of NEDs has evolved over the past two years. From the company perspective, 58% report an increase in workload, 41% believe it has remained stable, and only 1% note a decrease. From the NED perspective, 78% perceive an increase, 22% consider the workload stable, and none report a decrease.